Cash flow can be a consistent challenge for staffing companies, especially new and growing firms. With ongoing payroll obligations and lengthy invoice payment terms, temp staffing companies are often faced with cash flow gaps that are difficult to bridge. These working capital challenges lead staffing agencies to turn to factoring.

What Is Invoice Factoring?

Invoice factoring is a type of alternative financing in which a staffing agency sells its unpaid invoices at a discount in exchange for a cash advance.

Staffing firms need to make payroll on a weekly or bi-weekly basis, but their clients typically don’t pay for at least 30 days, if not longer. Factoring enables staffing companies to access working capital much more quickly, which allows them to meet payroll on time, cover operational expenses, and take on new contracts that they may have otherwise been unable to do.

How Does Factoring Work for Staffing Companies?

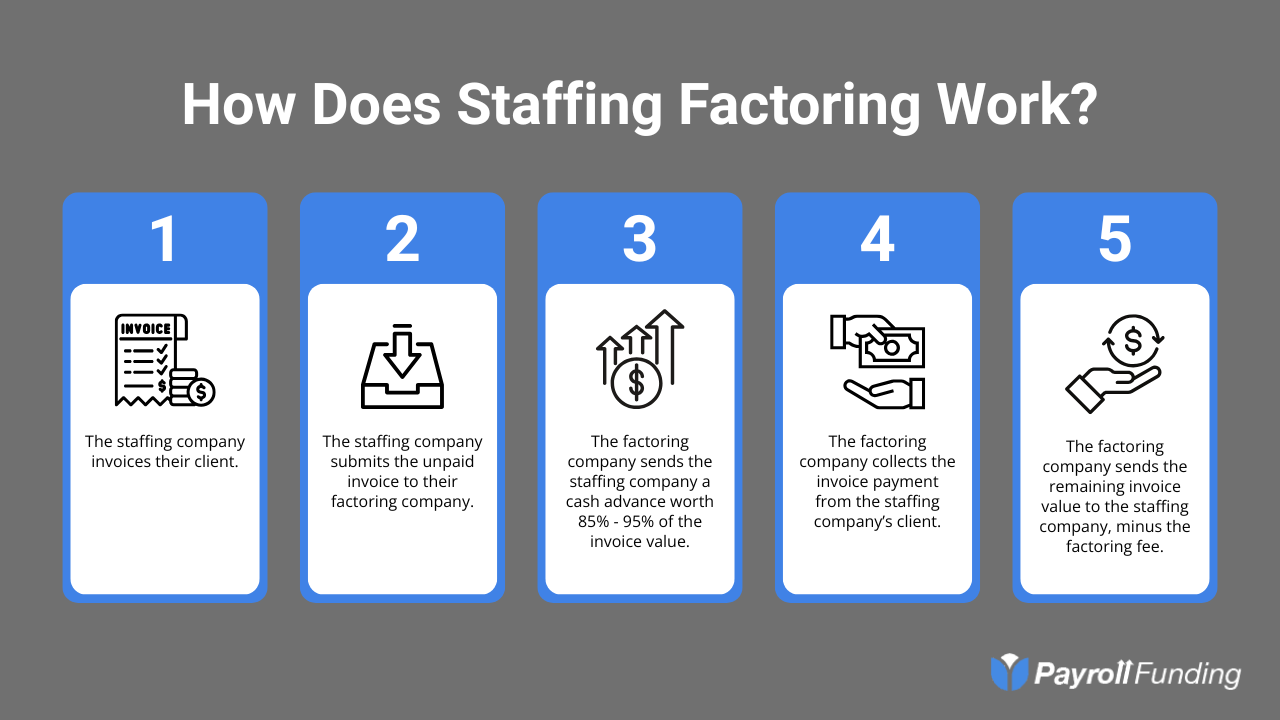

Staffing factoring is a simple process. Below is a breakdown of how it works:

- The staffing company sends an invoice to their client.

- The staffing company submits this same invoice to the factoring company for funding.

- The factoring company advances 80% to 95% of the invoice value to the staffing company.

- The factoring company collects the invoice payment on the staffing company’s behalf.

- Once the invoice has been paid, the factoring company sends the remaining invoice value to the staffing firm, minus the factoring fee.

Depending on the staffing factoring company that you work with, you will submit invoices via email or through an online factoring portal. Additionally, you will be able to choose how you receive your cash advance (through wire or ACH).

Staffing Factoring Approval Process

Invoice factoring tends to have a more lenient approval process than traditional financing options. Since a staffing agency’s debtors are responsible for paying the factored invoices, factoring companies put more emphasis on a staffing agency’s debtors’ creditworthiness than on the staffing agency’s creditworthiness. Because of this, startup staffing firms and those with poor credit are more likely to be approved for invoice factoring than for a bank loan or line of credit.

Benefits of Invoice Factoring for Staffing Firms

Invoice factoring has many benefits, especially for staffing agencies.

Get Paid Faster

The primary benefit of working with a factoring company is that staffing agencies can access cash faster. Whether you need to make payroll, pay vendors, or staff a new contract, factoring your staffing invoices gives you greater control over when you get paid.

Staffing clients often require you to offer net 30 terms, but others, like government entities, take even longer to pay their invoices. Through factoring, staffing agency owners can get paid in a matter of days.

Easier Financing Approval

Invoice factoring is typically more accessible than traditional types of financing, such as loans or lines of credit. The factoring approval process is less stringent, and staffing factoring companies can usually work with clients that have less-than-ideal credit scores.

Factoring is particularly popular with startup staffing companies that have less than a year of operating history. While traditional lenders often cannot work with these younger businesses, factoring companies are more likely to do so since financing approval is heavily tied to your debtors’ credit histories, rather than your own.

No Debt or Collateral Necessary

Unlike bank and SBA loans, invoice factoring doesn’t require staffing agencies to take on debt or put down collateral. Instead, the invoices act as collateral, so there is no need to come up with a lump sum of money, which can be difficult for many business owners to provide. Additionally, because factoring is the sale of your invoices at a discount, you incur no debt.

Receive Invoice Collection Support

Factoring companies for staffing agencies have a vested interest in getting your invoices paid because their success is tied to your success. Because of this, factoring companies provide invoice collection support, taking some of the back-office responsibilities off your plate.

Invoice Factoring vs. Payroll Funding

Invoice factoring and payroll funding are the same thing. People refer to these types of financing interchangeably, and some even combine the terms into one: payroll factoring. If you hear these phrases, they are all referencing the staffing factoring process.

How to Choose a Staffing Factoring Company for Your Business

Selecting an invoice factoring company in the staffing industry is a very important decision. Unfortunately, not all factoring companies are created equally, so you’ll want to take the time to research your options. Below are some aspects to consider before signing a factoring contract:

- Advance rate: A typical advance rate is between 80% and 95%.

- Factoring fees and structures: There are several types of fees and structures in the staffing factoring industry. Be sure to read the contract in full and understand each fee that is mentioned. And don’t be afraid to ask questions if you don’t understand a contract clause.

- Contract length and termination requirements: Staffing factoring contracts tend to be one to two years; however, most contracts use auto-renewal, so be sure to note your cancellation window to avoid getting stuck in an unwanted contract.

- Speed of funding: Factoring companies typically fund invoices within one to two days. If you prefer same-day funding, it may be more expensive due to wire fees and same-day processing fees. ACHs are usually cheaper, but they take a day or two to process.

- Customer service: Ensure that your factoring company offers quality customer service. Some companies rely on call centers to handle client inquiries, which can create a lower-quality experience. Factoring companies for staffing agencies that match you with an individual account manager usually have better customer service because the account manager is familiar with both you and your debtors.

- Third-party ratings: Exploring third-party ratings, such as Trustpilot or Google reviews, can give you a good idea of the reality of working with a factoring company.

- Experience in the staffing industry: Working with a factoring provider that is familiar with the staffing industry can create a smoother onboarding experience and factoring process.

RELATED: How to Pick the Right Payroll Funding Provider

What Types of Staffing Companies Is Factoring Right for?

While there are staffing companies that focus on nearly every service industry, they all operate similarly and often experience the same cash flow problems. Here are just a few kinds of temp staffing companies that are a great fit for payroll factoring:

- Temporary staffing

- IT (information technology) staffing

- Healthcare staffing

- Light industrial staffing

- Administrative staffing

- Hospitality staffing

- Event staffing

- Security staffing

- General staffing agencies

Ready to Start Factoring?

Fill out our form to get matched with an invoice factoring company that specializes in the staffing industry. If you’re not quite ready to take that step, you can browse our directory of staffing factoring companies to find the right fit for you.